Hello Friends! We are back with another informative content about Finance. The Tax Table has been created by the Australian tax department in order to assist employees with calculating the amount of tax withheld from their income. In this article, you will learn the Daily, Weekly, Fortnightly, and Monthly Tax Tables for 2023. Therefore, reading the entire article for proper understanding is essential.

What is Tax Table?

Table of Contents

A tax table is a tool the IRS provides to make it easier to calculate the amount of taxes to report on your federal income tax return. It is a chart that shows how much tax is owed based on income.

Australian govt official portal also provides Tax withheld calculators ATO that you can easily use.

Tax Calculator Australia

| Sections (2022-23) | Gross Income (2022-23) | Superannuation (2022-23) | Tax (2022-23) | Medicare levy (2022-23) | Net income (2022-23) |

| Weekly | $1,923.08 | $201.92 | $441.67 | $38.46 | $1,442.94 |

| Fortnightly | $3,846.15 | $403.85 | $883.35 | $76.92 | $2,885.88 |

| Monthly | $8,333.33 | $875.00 | $1,913.92 | $166.67 | $6,252.75 |

| Annually | $100,000.00 | $10,500.00 | $22,967.00 | $2,000.00 | $75,033.00 |

Australian GST Calculator Free

Australian GST Calculator

Include GST

Exclude GST

Price (ex GST): $0.00

GST: $0.00

Price (in GST): $0.00

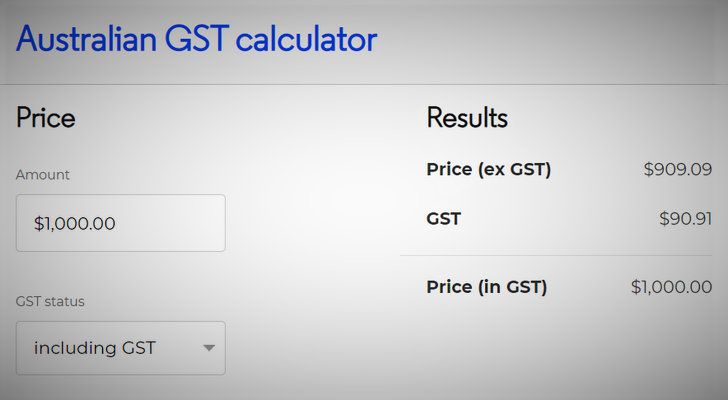

What is GST Calculator Australia?

GST Calculator is a tool that helps people with their taxable sales. The cost, including GST, is calculated by multiplying the amount exclusive of GST by 1.1. Here is an Australian GST Calculator image based on MoneySmart.

Credits: MoneySmart

How to calculate Australian Income Tax?

Most citizens are required to pay income tax, regardless of whether they are employees, employers, or self-employed. Here is a video that will help you to Calculate Australian Income Tax.

Credits: Connor & Alan | YouTube

Different slabs of taxation have been prepared based on people’s income.

Frequently Asked Questions:

What is the tax table?

The IRS provides tax tables to calculate your federal income tax return easier. Based on your income, you will see how much tax you owe.

What are the payroll tax rates for 2022?

The federal payroll tax rate is usually 15.3%, with the employee paying 7.65% and the employer paying 7.65%. In the case of a sole proprietor or business owner, who is self-employed, they will be responsible for paying the complete 15.3% of self-employment taxes.

Will tax brackets change in 2023 Australia?

For the income year 2022-23, no changes were made to tax rates or income thresholds in the Federal Budget of 29 March 2022.

Conclusion:

In this article, we have shared some information regarding Tax Table and Australian Income Tax Rates Weekly, Fortnightly, Monthly, and Annual in 2023. Our aim is to provide you with proper and helpful information. I hope you enjoyed it. In the comment section below, we would love to hear about your experience. For more information, you may visit, Beforecart.com.

Thanks for reading.