Personal Loan is such a thing which is needed by millions of people in today’s world. Some need money for travelling, some need money for marriage, and apart from this, there can be many reasons for which instant money is required. In such conditions, apart from a personal loan, we cannot take any other loan if we need instant money.

There is now only one option for us: a personal loan. A personal loan can be taken in two ways: directly from the bank or through Navi Personal Loan.

Most likely, you have heard of Navi Personal Loan, which offers you an instant loan. Navi Personal Loan is not the actual name of the company. This company has disbursed many personal loans in the past few years, so people call Navi Personal Loan. In addition to Personal Loans, Navi also offers Health Insurance, Home Lone, and Mutual Funds.

This article will discuss whether you should take a personal loan from the bank or Navi company. Along with this, we will also tell you about the advantages and disadvantages of a Bank personal loan and a Navi personal loan.

In order to apply for a personal loan, which platform is better, Bank or Navi?

Table of Contents

If you want to take a personal loan from the bank, then there are two ways to apply for it,

- Apply Online or

- Visit a Branch

There is only one way to apply for a personal loan in Navi. To apply for a personal loan, if you are an Android user, go to the Google Play Store, and if you are an Apple user, go to the App Store and install its app on your phone.

On applying for a personal loan in a bank, the Rate of Interest goes from 12% to 25% or 30%. Now a question will come to your mind, “Why is such a high-interest rate charged on a personal loan?”

For example, If we go to the State Bank of India to take a personal loan, they will fix the interest rate from 12% to 25% or 30% according to our Cibil Score. You must pay at least a 10% interest rate no matter how good your Cibil Score is.

If we apply for a home loan in the same State Bank of India, the bank will offer us a loan with a 6% to 7% interest rate. Now you are probably thinking, why is the interest rate on a personal loan so high compared to a home loan?

The interest rate on a personal loan is charged so high because a personal loan is unsecured, while a home loan is secured. Suppose you have built a house by taking a home loan. In this situation, your house is like a mortgage with the bank until you pay the full loan to the bank.

But it is not so in the case of a personal loan. A personal loan is such a thing which provides you with bank instant, just by looking at your credit score or cibil score. Based on your Cibil Score, the bank gives you a personal loan of up to Rs 20 lakh. That’s why it is an unsecured loan, and banks charge you 12% to 30%.

Whatever your Cibil Score, no bank will offer you a personal loan below 10%. If we talk about Navi, it is said that the interest rate of their personal loan starts from 9.90%. But don’t think that everyone will get a 9.90% interest rate.

According to Navi’s official website, the interest rates for personal loans start at 9.90%, while other banks charge at least 10%. Here, Navi is displaying its cheapest loan rates for personal loans.

For your information, let us tell you that a personal loan in Navi starts from 9.90%, but it can go up to 36%, depending on your Cibil Score. Thus, when you apply for the loan, it will display what percentage charge will be applied to the limit sanction you are receiving. If it is showing a 25% charge, an option to Avail Now will appear at the end of the screen.

If you want to take a loan with the given rate of interest, then you can receive the loan amount in your bank account by clicking on the option of Avail Now. But if you think that 21% is too much, then you can also exit from here and in that case, you will not get a loan.

When we take a personal loan, we also have to pay a processing fee, which we call File Charge. If we talk about banks, the bank will definitely charge you a processing fee of at least 3%. Sometimes it also depends on the bank (Banks may charge 2%, some 3% or 3.5%).

On the other hand, if you talk about Navi personal loan, it will charge you processing fees ranging from 3.99% to 6%. So in this way, the bank is better at processing fees than Navi’s personal loan.

The rate of interest we compared earlier will mainly depend on your Cibil score, whether you apply for a personal loan in Navi App or any other bank.

The biggest disadvantage of applying for a loan in a bank is that if you give an online personal loan request today, it will take at least a week to get a response from the bank. Even if you upload all the documents online, the bank takes a lot of time.

In this case, Navi has one advantage if your credit score is good and you successfully apply for the loan; your loan will be instantly disbursed, and you will not have to wait even a bit. Once you submit your PAN number on Navi App, it will fetch your credit score. If your cibil score is perfect and your income is good, you do not have to wait a bit. The processing is very fast, which is Navi’s biggest advantage.

Another big difference between Bank and Navi is that banks give personal loans only to Salaried people. If you are a businessman or self-employed, the bank will give you a business loan, not a personal one.

But there is no such condition in Navi. Whether you are in a salaried class or self-employed, in both cases, Navi gives you a personal loan; just your credit score should be good. A major disadvantage in Navi is that if you do not pay any EMI on time, then 2% of that EMI will be taken from you as a monthly penalty, which means you will have to pay a penalty of 24% annually.

So here the overall conclusion comes out that if you are not in a hurry to get the loan i.e. you do not have any problem with getting the loan within 10 to 15 days, then you can go with the bank.

And if you think that you can pay regular EMI and need an instant personal loan, then you can choose Navi personal loan. In this case, pick up your mobile, install the Navi app, and apply for a personal loan. But How to get Navi personal loan? Now, we are going to explain ”How to apply for a personal loan on the Navi App?”

How do I apply for a personal loan on Navi App?

To apply for a personal loan on Navi App, follow these simple steps:

Step 1: Open the Google Play Store or App Store, search for the Navi app, and download it on your phone.

Step 2: As soon as you open the app, the interface will open in front of you where you will see the option of Personal Loan, Health Insurance and Home Loan. Since you need a personal loan, you will choose the first option.

Step 3: Now you have to enter your mobile number. It can also automatically fetch your mobile number. After that, you have to click on the mobile number.

Step 4: You will get an OTP for your phone verification. You must complete the phone number verification process by putting that OTP in the required place.

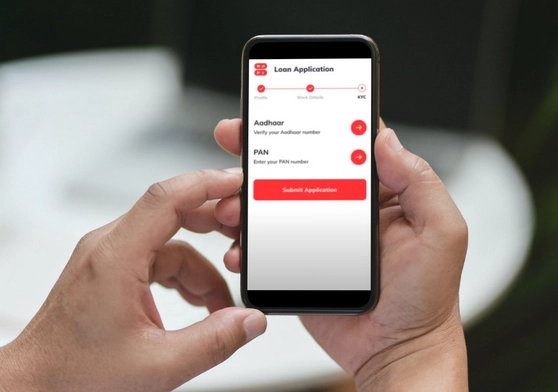

Step 5: On the next page, you will have to fill in personal details like Full Name, Date of Birth, PAN Number etc.

After correctly filling in all the details, you have to click on the option of Next, written below.

Step 6: A new page will open in front of you where you will be asked about your Employment Type and Total Monthly Income. After carefully filling in all the details, click on the option of Next.

Step 7: On the next page, you will have to verify Employment details, where you will be asked for the company’s name. So whatever the name of your company i.e. where you work, you have to search and enter it.

Step 8: After entering the company’s name, you will see the option to generate EPFO OTP at the bottom of the same page; you have to click on it. Now again, an OTP will be sent to your mobile. After entering that OTP, you have to click on the verify option written below.

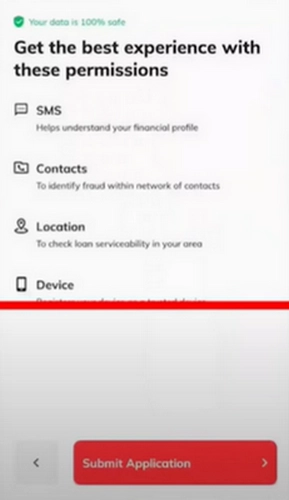

Step 9: After OTP is verified, a new interface will open where you will have to give some phone permissions like SMS, Contacts, Location and Device.

You have to allow all the permissions. After that below, you have to click on the option of finally Submit Permission.

Step 10: Now, it will take some time to process. This means it will fetch your PAN number and determine your eligible amount.

Step 11: If your past cibil score is good, a page will open in front of you where the EMI amount will also be shown along with the loan amount. After that, you have to click on the option of Next.

Step 12: On the next page, you will be asked to upload your Aadhar and PAN cards. After uploading them, you have to click on Submit Application below.

After this, Navi will verify your details again, and the sanctioned amount will be transferred to your bank account.

Recommended:

Turtlemint Pro App Complete Guidelines.

How to make money from Turtlemint Pro App in 2023?

Conclusion:

Through this article, we have tried to give you complete information about Navi Personal Loan. We have told you the whole process of comparing banks with Navi and applying for a personal loan in Navi. We request you read all the terms and conditions carefully before applying for the loan on the platform. This article has been prepared to provide information to you, and it’s your responsibility to take any decision.

Thank you for reading the full article!