eToro is one of the largest and most successful social trading platforms in the world. Founded in 2007, eToro has been offering a free trading platform for customers to connect with other traders and exchange financial assets since its inception. Since then, it has made a name for itself in the online industry by providing investors with a safe and efficient way to trade on global stock markets as well. In addition to providing an easy-to-use interface that allows novice traders to easily get involved with equity trading, eToro offers many other benefits, which may surprise you, and we bet you never heard it before.

It goes without saying that eToro needs to be able to balance its customer service with its non-trading revenue in order for this model to work. Fortunately for eToro, the site seems pretty user-friendly. I particularly liked how I could watch other traders’ live trades and portfolio balances on my dashboard.

In case you’re reading this article, chances are very high, that you already have an account with at least one social trading site. The difference is that eToro allows you to manage your entire portfolio from the same home page, where you can also view detailed news and graphs. Also, unlike most other sites, it offers a mobile app for iOS and Android devices.

What eToro isn’t is a forex trading platform; rather, it’s an alternative investments site with a powerful social trading element. It’s this unique combination that has attracted regulators in Europe and the United States who have signaled their belief in eToro as a legitimate financial market intermediary.

What is eToro?

Table of Contents

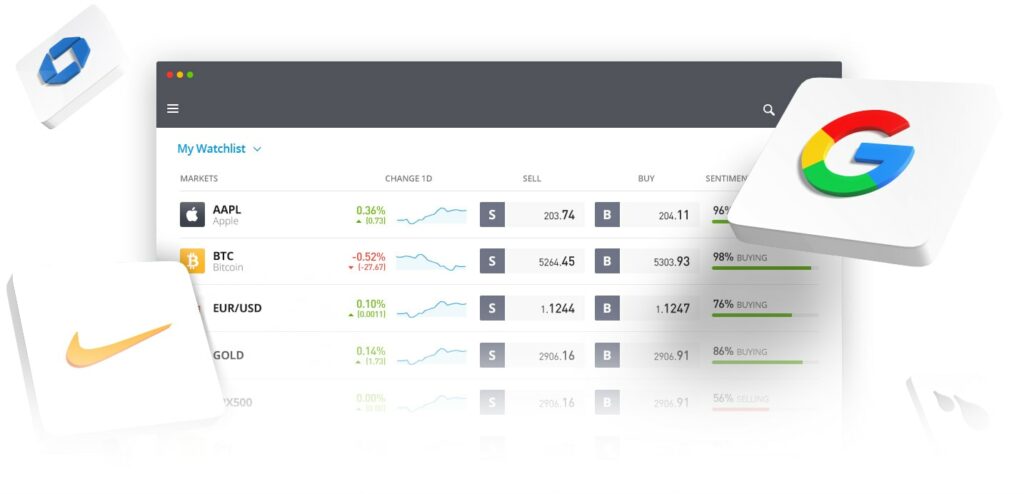

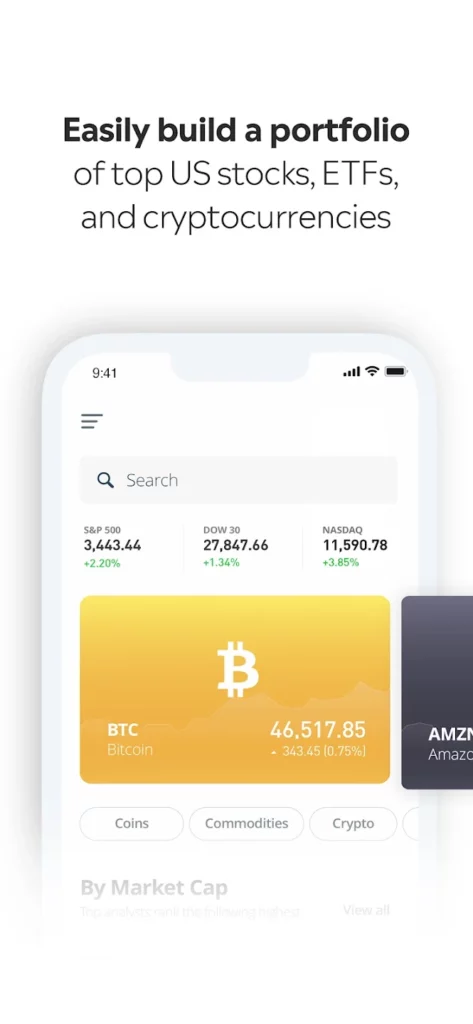

eToro is a global investment platform that offers the ability to trade stocks, currencies, commodities, indices, and ETFs as well as cryptocurrencies. It’s also one of the largest social trading networks with millions of users in over 190 countries around the world.

The company’s mission is “democratizing finance for all.” To do so they created their own cryptocurrency called eBTC which can be used on the platform as a payment method for trades or withdrawn from your account at any time.

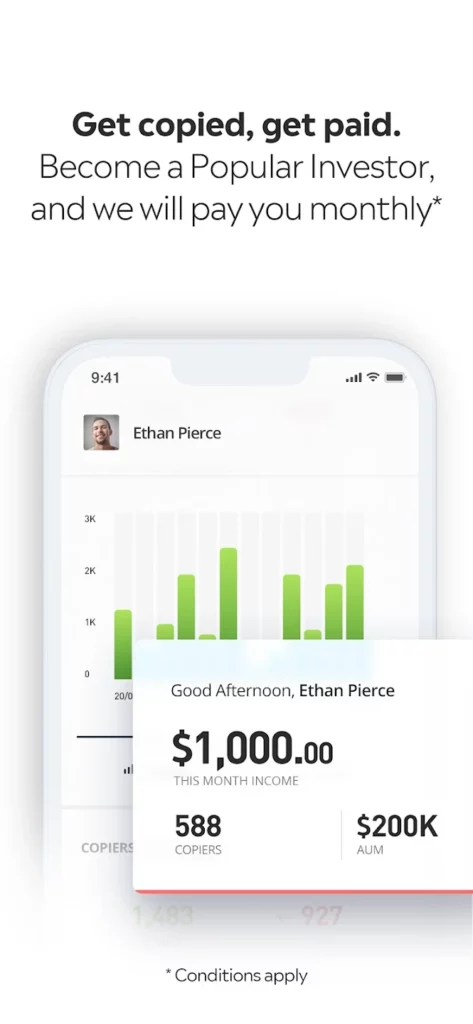

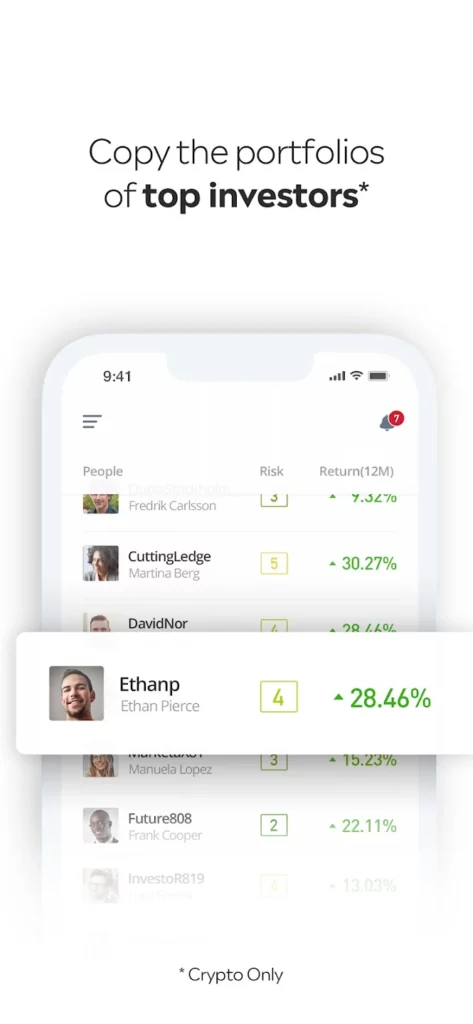

They offer traders the opportunity to copy other traders, who are called “Copy Traders” on the platform. This feature allows users to trade more efficiently and effectively by following the best-performing individuals in their community.

eToro is one of the World’s largest and most successful social trading platforms, eToro.

eToro is one of the largest and most successful social trading platforms in the world. It was founded in 2006 by Yoni Assia and Ronen Cohen, who had previously founded another company called Optionalexchange, now known as OptionAlpha. eToro has been used by more than five million users from over 180 countries around the world to trade on its platform since it launched in 2007.

eToro is a regulated company that operates under strict financial regulations set by various governments such as Cyprus, Malta, and the UK which require them to follow certain regulations such as paying taxes on profits made from transactions made through its website or mobile app whenever possible (you can read more about this here).

Recommended: eToro Quiz Answers – Trading Knowledge Assessment 2022

eToro Funding, Revenue & Valuation

Social Trading Broker eToro was founded in 2006 and is headquartered in Israel. The company has raised over $300 million in funding from investors such as Bessemer Venture Partners, Battery Ventures, and more. eToro’s valuation is currently at $1 billion, making it one of the world’s most highly valued startups.

eToro currently has over 10 million registered users across its platform with 80% being active traders on a daily basis (Source: SEC filing). eToro aims to become “the biggest social trading network” by expanding into new markets including China and India; however, they have faced some issues related to dealing with regulators who don’t approve crypto exchanges there yet which could affect their growth potential significantly if present trends continue for long periods of time longer than expected or hoped for when setting up shop overseas.”

eToro has over 120 employees and is based out of Tel Aviv. The company was founded by Yoni Assia, Ronnen Assia, and David Ring in 2007. eToro has raised over $300 million in funding from investors such as Bessemer Venture Partners, Battery Ventures, and more

.

How Does eToro Make Money?

eToro has a business model that is similar to a stock exchange. In order to make money, eToro charges fees on the transactions that take place on its platform. For example, if you want to buy shares in Microsoft, you would pay $3 in fees and then wait for them to be sold at market price (the price at which sellers want their shares).

If there were no other buyers around then it might take up to 10 minutes before your trade would complete successfully but if there were many buyers who wanted those same shares then they would probably sell themselves quickly and cut down your waiting time significantly.

eToro charges a fee on every trade that takes place on its platform:

- $2 per transaction (for regular customers)

- $10 per transaction(for VIP accounts)

eToro has been one of the most successful social trading platforms in the world. The company makes money by charging fees on the transactions that take place on its platform. eToro charges a fee on every trade that takes place on its platform: $2 per transaction (for regular customers) and $10 per transaction(for VIP accounts)

eToro makes money by charging spreads on trades, overnight and weekend fees, withdrawal fees, currency conversion fees, and inactivity fees.

Also Read: What Happened To Vine?

Spread gives eToro More money

A spread is a difference between Ask-Bid( Ask minus Bid), for any financial assets. Spreads are applicable whenever an asset is brought or sold. That’s the main source of income in eToro Broking. For example, let’s say if any asset bid is 1.2123 and the Ask price is 1.2125 then the difference is 0.0002 which is mainly the profit of these social trading brokers.

It seems to be very small but when trading happens in large volume then it becomes enough money to get flow into the systems. The assets were spread more the chances of eToro making money are higher. This spread is applicable anywhere, be it cryptocurrencies, stocks, futures, options, and much more.

As this is a social copy trading platform, its users help to create a maximum volume of trading and help eToro to collect more money from these trades.

You may also read; How did Paypal make money?

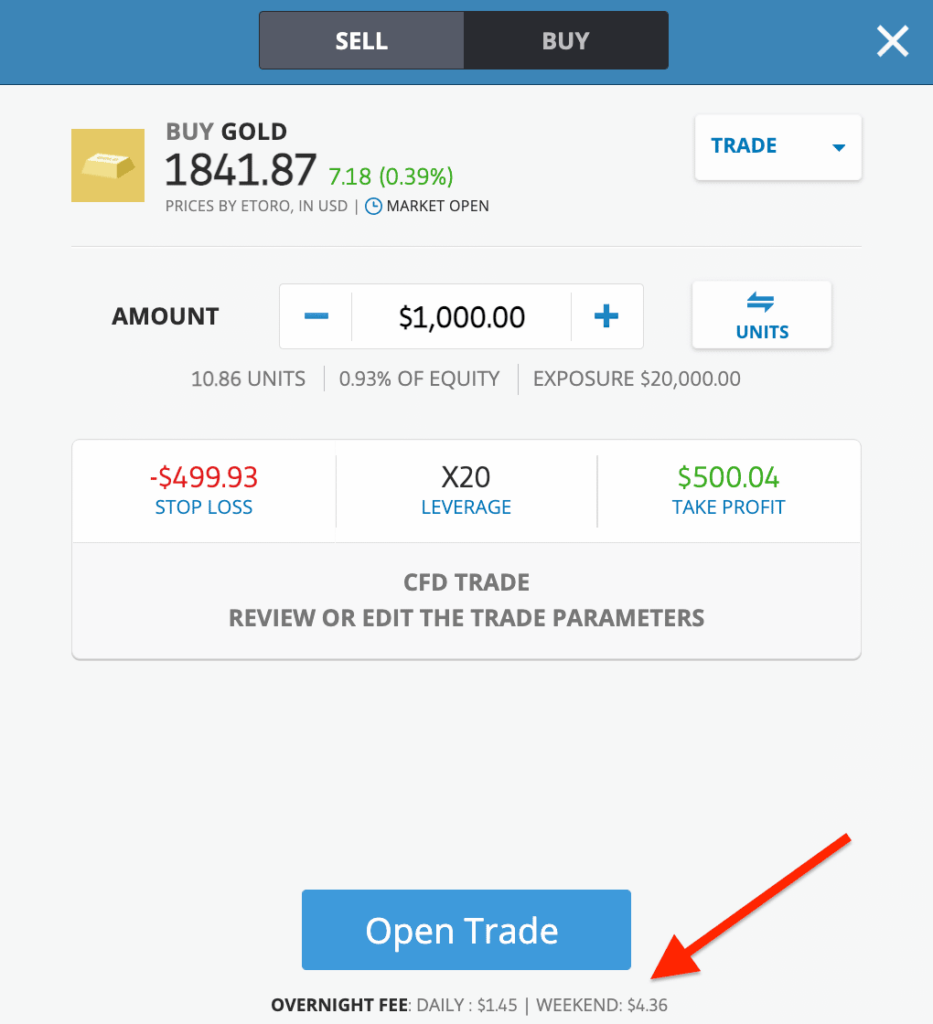

Another source of Income eToro makes from Overnight & Weekend Fees

Just like most CFD trading platforms charge overnight and weekend fees, including eToro. In exchange for these fees, eToro loans the user money to hold the assets overnight or through the weekend. A variety of fee structures apply to different types, positions, and volumes of financial assets. It is possible for rollover fees to change according to global market conditions.

In addition to its overnight and weekend fees, eToro also applies the London Interbank Offered Rate (LIBOR). For borrowing funds over the weekend or overnight, banks charge each other LIBOR.

Withdrawal & Conversion Charges

Users are charged a withdrawal fee if they withdraw money from their trading account to their bank account.

This account is capable of handling international money transfers. A withdrawal fee of $5 is charged, and the minimum withdrawal limit is $30 at least. In bellow, they don’t allow users to withdraw.

A conversion fee applies to all withdrawals other than US dollars. Calculate conversion fees by comparing two percentages, or percentages in points (PIPs).

As an example, moving from 50 percent to 55 percent is a five-percentage point increase, but is a 10-percentage point increase.

According to the currency in which they are being exchanged, percentage points vary. It costs 50 percentage points more to convert from USD to EUR. So try to withdraw money in USD which cost minimum fees compared to other currencies.

The tier in which an eToro Club member is enrolled determines whether they receive a discount on conversion fees or are exempt from paying them.

Also Read: What Happened to Myspace

eToro Charges Inactivity Fee

eToro applies an inactivity penalty when some users didn’t log in to their account within 12 months. If you haven’t logged into your eToro account for 12 months, you will be charged $10 from your remaining balance. The charges may vary from country to country, but they only deduct this money from your available balance, they didn’t levy this from closing your already running or opened trades.

Who owns eToro?

Israeli multinational eToro offers financial and copy trading services through its social trading and multi-asset investment platforms. It’s owned by eToro Group Limited and listed on the London stock exchange, soon it will be available on Nasdaq Stock Exchange.

What’s next for the company?

A large number of people use eToro around the world. eToro is also a leading platform for social trading and cryptocurrency trading. The company makes money by charging fees on transactions. As an example, you would pay $3 in fees if you wanted to purchase shares of Microsoft and wait for them to be sold at market value. Your trade might take 10 minutes to complete if there are no other buyers around, but if there are many buyers who want the same shares, they would probably sell themselves quickly, and blockchain technology would enable that.

Social Trading Broker Etoro was present since 2007, but In 2013, eToro launched in America and has since gained popularity across Europe, Asia, and America. By opening an office in Sydney, Australia’s largest financial center, the company has recently expanded its operations!

Read: Zoom Business Model

You can also copy-trade stocks, bonds, or commodities on their platform if you want more opportunities without having to invest real money (which means no risk).

In contrast to traditional trading platforms like Coinbase, where you have to wait days or weeks to see anything, you can copy others’ trades which will appear in your portfolio within seconds. It may sound intimidating, but once we explain how everything works together, you’ll see why everyone wants us here. Even though these companies may claim otherwise, they don’t guarantee privacy when they purchase crypto directly from exchanges like Airbnb.”

Conclusion

eToro makes money by charging spreads, withdrawal fees, conversion fees, overnight and weekend fees, inactivity fees, etc. This is one of the successful business models in the trading industry.

eToro is a great company, and I believe that it has a bright future. The platform has hundreds of thousands of users, and they keep coming back because they enjoy using it. The company also knows how important social trading can be for traders, so they continue to add new features to make the experience even better than before. With all these benefits combined, it’s clear why eToro is one of the best investment platforms on the market today!