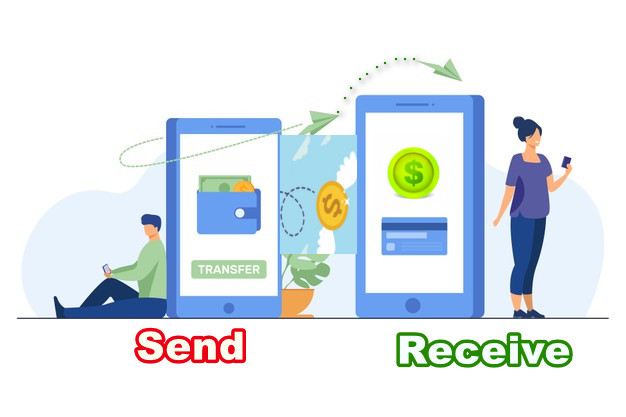

How does Venmo make money? Venmo is a social peer-to-peer payment solution originally built for friends splitting the bill, but it has since expanded into facilitating business and person-to-person transactions. Venmo had to offer a highly intuitive mobile experience. This task wasn’t easy for Venmo because it was a brand-new concept for the market.

However, with the introduction of its app on iOS and Android and its payments through your smartphone’s camera, they were able to achieve its goal of one day reaching every social network user in America. Venmo is the perfect tool for anyone who wishes they could secretly send money from their phone, like Instagram Stories and Snapchat Stories.

Venmo makes money by charging a 2.9% service fee on each transaction. In addition, they charge an additional 30¢ to send money internationally or from your bank account. The service is free to use for sending money within the U.S. However, there are limits to the amount you can send without a Venmo balance, which could be considered a fee.

Your Venmo balance is funded via a bank account or linked debit/credit card. Additionally, if you have a large amount of cash in your Venmo account, they will fund it with the subsequent transfer from your bank or card.

Must Read: How Does Zoom make money? Secrets Behind the successful Zoom Business Model 2022

They will make money by charging the next person you send money to and after that until you eventually run out of cash. Your bank determines the exchange rate between your bank account or card, Venmo balance, and other currencies. Venmo will charge a fee to take the rest if you do not have enough in your account. It allows the users to store their money in a digital wallet for an account fee of $0.99 per month or 0.99 cents per transaction approx.

Venmo makes money from the transaction charges of its users. Venmo charges vary depending on the region but are 3% in the US, Australia, Canada, and India. If you’re a business owner or account holder that falls under one of these countries, Venmo may be off-limits to you due to this percentage. It’s also worth noting that it can take up to 24 hours for transactions approved by Venmo to show up in your account balance with some banks.

Below is a comparison chart of the costs for various banks:

This fee isn’t unique to Venmo; it’s something that all P2P sending services, including Square Cash and PayPal, charge. Venmo also charges a monthly cost of $0.25 (“Turkey” region only), which is on top of their per-transaction fee. Venmo does have a few customer service reps to help you work through issues with your account or transactions for what it’s worth. If you have a problem that requires a human being to walk you through something, such as helping you set up account alerts or troubleshooting a failed transaction, they’ll undoubtedly be happy to do so.

What is Venmo? Who founded it?

Table of Contents

What is Venmo? Who founded it? The answer to the first question is that Venmo is an app that easily transfers money between your bank account and your friends’ bank accounts. It works similarly to PayPal but without as much trust in it. It’s a quick and easy way for people close to one another to communicate when they don’t have cash on hand or access a checking account. The application is available for both Android and Apple devices.

This article serves two purposes. The first is to inform the general public of this service often used by college students and high school students to pay back money owed to them for something. The second purpose is to inform parents of this service to take steps to prevent their children from falling into a horrible trap that can cause serious harm to their finances or even bad legal consequences down the road.

“Venmo is a platform founded in 2009 by two friends, Andrew Kortina (co-founder) and Iqram Magdon-Ismail. These two guys just changed the way we pay each other. They created a digital money transfer service allowing users to store their money in a virtual wallet. In addition, the company introduced a different approach to managing money with the app. Using this app, the users take payments directly from their friends and send payments without using cash or credit cards. Venmo Co-Founder Andrew Kortina said The name Venmo stands for “payments network.” It’s an international system of virtual debit cards – similar to a PayPal account – that’s designed with millennials in mind.”

Venmo is the fastest-growing way for people to send money worldwide and has amassed a massive $8.7 billion in transactions. It may be because Venmo, which Paypal owns, allows users to instantly transfer money from one person’s account to another’s and keep track of what they owe each other with a running list of transactions.

Also Read: How much do peloton instructors make?

History of Venmo & How did it start?

Initially, the company’s headquarters was in Philadelphia, but very soon, it was relocated to New York. In 2001, Andrew and Iqram met with each other during an event at the University of Pennsylvania. They both had a Computer Science branch. But later, Andrew changed his major to Philosophy and Creative Writing. They were excellent friends and roommates as well. Later, they decided to start their own company. They were continuously experimenting with many ideas until no ray of hope. Andrew moved to New York and became one of the first engineers at URL (Uniform Resource Locator), shortened t bit.ly. In the meantime, Iqram did software work for the Ticket Leap in Philadelphia.

In 2009, Iqram paid Andrew a visit to New York. Unfortunately, he forgot to bring his wallet, forcing Andrew to pay for the weekend. Fortunately, this minor incident sparked the idea for Venmo. Venmo is the combined name of Mo, which stands for mobile, and Vendere (A Latin phrase that means ”to sell”). Initially, Venmo was designed to send and receive payments via Short Message Service (SMS). Very soon, their inboxes were flooded with jokes and funny messages accompanying those money transfers.

So, Andrew and Iqram started thinking from the customer’s perspective. They realized what attracted people to Venmo. They added a few features like Facebook, which allowed Venmo users to check the purpose of exchanging money with their friends. The old boss at Ticket-leap, Iqram Magdon-Ismail, became the company’s first angel investor.

Venmo Funding: They raised their first official round of venture capital funding in 2010 from RRE Ventures, Andrew’s former employer Betaworks, Founder Collective, Lerer Ventures, etc. Initially, Venmo started full-time, and a 1.2 million dollar seed investment is allowed. Venmo remained in the private beta version for the first two years of full-time operation until 2012. Initially, Venmo was only accessible via invite, allowing the duo, Andrew and Iqram, to deliver the best product. That strategy took a lot of time. In 2012, when Venmo released its product to the public, it was already in payment exchanges for that year to facilitate 250 million dollars.

Don’t Miss: How does Robinhood make money? – Find out the Secrets Behind the success of Robinhood Business Model 2022

After a couple of months of launching, an announcement came from Braintree that it would acquire Venmo for more than 26 million dollars. Braintree is a provider of software for online payments. The division of PayPal handles all transactions between buyers and merchants. In the past, it handled the payments process for the companies such as Airbnb, Uber, etc. A strategic move to develop a solid position in the mobile payment area was the acquisition of Venmo.

In 2013, a significant announcement came from PayPal that it would acquire Braintree, including Venmo, and all its assets for the massive amount of around 800 million dollars, which helped PayPal operate both companies under their brand. In 2014, both Andrew and Iqram left Venmo. According to the report, the founders looked more disinterested in meetings. Mike Vaughan, the COO of Venmo, took up the General Manager post of Venmo.

A sudden change in management didn’t affect much in the company’s growth much. In 2015, Venmo launched its pay features, which helped users pay with Venmo at any merchant, a PayPal partner. The move was one of Fintech’s mainstays and allowed Venmo to reach millions of new PayPal partners. Still, the company faced many problems and controversies throughout the year. The users faced many issues, and they issued massive complaints claiming that others had scammed them. Moreover, Venmo stopped transactions due to inappropriate terms like Idek, which social media users use as the short form of I don’t know.

Venmo has become one of the most significant P2P payment services in the United States of America despite these problems. Presently, Venmo processes almost 10 billion dollars every month. It is just behind the leading money-transferring applications such as Square’s Cash App and Zelle App. Millions of users open this app regularly for their daily usage. Venmo appointed thousands of people in four offices across the United States.

Also Read: Why Hq shut down?

How Does Venmo Make Money?

As we already in the previous paragraph, the idea of making this fantastic money transferring and chatting platform becomes a masterstroke.

Did you know that Venmo has been processing $5 billion in quarterly transactions for years? How does it do this and still stay afloat – even turning a profit? The answer is complicated, but it boils down to the perfect mix of deep tech skills, sharp business sense, and a dash of luck. It started in 2009 when two roommates from the University of Pennsylvania came up with an idea to streamline their money transfers. While Venmo is a peer-to-peer money transfer app, the Venmo story is much bigger than just that.

The founders have built a successful business on top of the underlying P2P functionality. The key to Venmo’s success so far has been its unique business model – combining the core P2P payment ability with patented technology that allows Venmo to expand into finance and beyond. The result has become a $10 billion business growing at 40% year over year (more on this below).

Recommended: How does Paypal make money?

Venmo Cash A Check Service

Venmo launched Cash A Check Service in January 2021. According to this new feature, the users need to turn on the location service and verify the email address required to direct deposit or own a Debit Card from Venmo. Then users take a picture of the check and review the process by the Venmo service provider. After the complete verification process, Venmo deposits the amount into the user a/c. Venmo charges one percent for these verification processes in exchange for a minimum of 5 dollars.

Recommended: SpaceX Business Model

Venmo Transaction, Withdrawal, and Interchange Fees

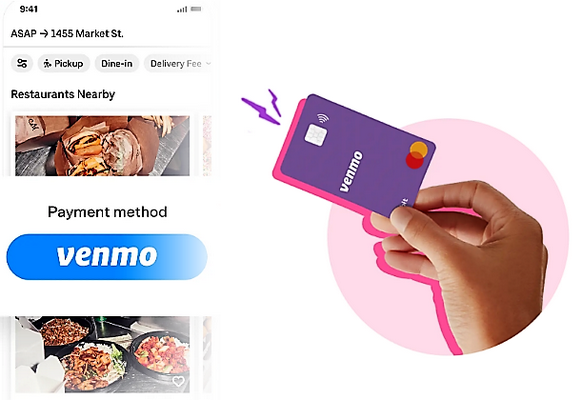

Venmo offers Debit Card for its users, which they can use everywhere for payments using their Venmo wallet balance. The card is beneficial for paying in coffee shops, restaurants, grocery shops, etc. After every transaction, the users get notifications instantly on their phones. Venmo also earns by charging merchants interchange fees from the card. Using the card ATM Domestic Withdrawal, Venmo charges two and a half dollars, and Over Counter, Withdrawal Fees take three dollars.

Venmo Cash Interest

Venmo users use this platform as a standard bank. The platform is user-friendly, and people use it very quickly. Like other banks, Venmo also utilizes the cash in its account to lend it to other banks. In this way, it takes interest from other banks.

Venmo Cashback or Rewards Program for Users

Selected merchants like Target, Donuts, Chevron, etc., provide rewards or cash back for using the debit card on their platforms. They give money back to the customer’s account for the overall purchase. In this way, Venmo earns money as a commission from the partner for referring the customers.

Expected Revenue of Venmo in 2021

In 2012, Venmo generated 36 million dollars in revenue, which increased to 48 million dollars in 2013. In 2014, Venmo generated $205 million in revenue while operating at a loss of about $100 million.

Dan Schulman, the Chief Executive Officer of PayPal, expects Venmo to generate over 900 million dollars in revenue throughout 2021.

Also Read: How Does VRChat Make Money? Secret Behind the successful VRChat Business Model 2021

How does Venmo work?

Venmo is a service that’s a lot like PayPal for your phone. You can connect it to your bank account and use the app to send and receive money with friends or pay for things online or in stores with Venmo. It’s simple, quick, and safe!

Venmo works like this: First, you sign up on the Venmo website or in the app. You’ll have your own Venmo account that connects to your bank account. Venmo works by linking a credit or debit card to the app and sending the money owed directly from their bank account into the user’s Venmo balance. Once signed up, you can use Venmo to pay for things online or in stores by selecting “Pay with Venmo” as a payment option. Or, you can send and receive money between friends using the mobile app. Also, Move on to How does ShopBack Make Money.

The two parties need to be registered on Venmo to transfer funds. Venmo will give you a feel like Messenger apps. It has the features to chat with each other or send emojis. It also offers users a debit card that is also connected to the application. The users can also use that debit card in the real world to make purchases.

People can use the card to purchase grocery items or at the coffee shop. At selected merchant partners, the users can also receive cash back. To learn about the new IRS rules and regulations, you may check out the video given below.

Credits: FOX 9 Minneapolis-St. Paul | YouTube

Some Quick Facts

- Venmo is a type of digital payment service that allows users to transfer money or make payments.

- Venmo was founded in 2009 by two college roommates, Andrew Kortina and Iqram Magdon-Ismail, and their friend, Andrew’s fraternity brother. Venmo became one of the most popular ways to pay for things on campus and eventually spread beyond college campuses worldwide.

- Venmo first began in 2009 when Braintree acquired Venmo for $26.2 million.

- It’s now owned by PayPal, which bought Braintree for $800 million in 2013 and officially launched Venmo as its standalone company in 2015.

- The company began operating in 2012. By 2013, Venmo processed between US$1 million and $2 million per month.

- In 2014, this grew to US$75 million per month, with a total of $800 million processed by the end of the year. In 2015, Venmo processed $17 billion in transactions between people.

- Venmo is one of the most popular apps in the world. It’s a money transfer service and social media platform that allows you to send and receive funds using your phone number easily.

- The app has been around since 2009 but has recently grown exponentially in popularity. Venmo reached $9 billion worth of transactions last year alone.

- The most common question among people is ”How does Venmo make money?” We have discussed everything briefly on the above. Please read it.

Also Read: How Does Discord make money?

Frequently Asked Questions:

Is Venmo safer?

Venmo uses data encryption to protect users’ information. You may also get some extra features on the Venmo app to protect your account. In order to make your Venmo account more secure, you can create a security PIN or use two-factor authentication.

Do I need a bank account for Venmo?

It is essential to have a bank account to withdraw cash. Your Venmo account must be linked to your bank account if you want to withdraw funds.

How much does Venmo cost per month?

There is no registration or monthly fee on Venmo. You will be charged 3 percent if you use a Credit Card.