How does Robinhood make money? Robinhood app is a mobile application that offers commission-free stock trading and investment services to users with self-directed accounts. It also does not charge fees for its no-fee checking or savings accounts. Robinhood is an app for everyone who has ever wanted to start investing but never knew how or where to begin when it comes to the confusing world of stocks and shares.

With over 5 million users, Robinhood has helped thousands of new investors launch their investment portfolios from the convenience and simplicity of their mobile phones or computer. This blog post will introduce you to what they do with their app and why they might be your new best friend when it comes to buying stocks.

It helps users to buy and sell financial assets like exchange-traded funds, options, gold, stocks, and cryptocurrencies. The users don’t have to pay any trading fees or brokerage fees. In addition, Robinhood offers access to trading in over 3,000 active markets and advanced charting tools.

The company was launched in December 2013 by a group of Stanford University students to democratize the stock market experience through technology. The Robinhood co-founders also created “a mobile app that enables people to quickly track their investments and manage their portfolios.

Robinhood is a mobile application that offers commission-free trades of stocks, ETFs, and options. In 2013, Robinhood was founded to democratize the financial system. The company has become one of the fastest-growing tech startups since its 2013 launch. It seems that the company allows its users to trade stocks without paying commission fees and makes money through interest instead of on those savings.

Robinhood makes money from subscription charges, stock loans, order flow payments, interchange fees, and uninvested funds. The headquarter of Robinhood is San Francisco, California, United States.

With a mission of ‘bringing commission-free investing to everyone,’ Robinhood is disrupting the US $26.6 trillion investment industry. Originally started as an app for the young and tech-savvy, this financial services company offers all of your traditional brokerage features with no commissions. Founded by Vlad Tenev and Baiju Bhatt, two Stanford graduates, in 2012, Robinhood’s mission remains unchanged.

Also Read: How Does VRChat Make Money? Secret Behind the successful VRChat Business Model 2023

What is Robinhood? Who founded it?

Table of Contents

Robinhood is a financial services company that allows people to buy and sell stocks, ETFs, options, and cryptocurrencies from their phones. The premise is simple: you want to try your hand at trading but don’t have the money or the patience to invest in big-name brokers like E-Trade, TD Ameritrade, or any other guy.

Baiju Bhatt and Vlad Tenev founded Robinhood in 2013. They were just 21 when they started Robinhood and saw a lack of offerings for young, tech-savvy people who wanted to trade stocks. So they used their savings to bankroll the idea, and a year later, it launched.

History of Robinhood & How did it get started?

Robinhood is a company based in the United States that provides online and mobile trading services. The company was founded in 2013 by Vlad Tenev, Vladimir Dubinin, and Baiju Bhatt in San Francisco, California, United States. Their parents were the origin of India and Bulgaria, respectively. After performing excellently at high school, they graduated in physics and math at Standford, where they met.

They became perfect friends and remained friends and roommates throughout their studies. Bhat went to New York City to work in finance after post-graduation, while Tenev took up a Ph.D. at UCLA. His tenure would barely be a few months in academia and finance. However, their tenure in the academic and financial world would last only a few months.

Bhatt invited his college friend Tenev to join him in NYC after getting a great experience with the operations of outdated and inefficient financial institutions. In 2009, they started their own company, Celeris. They both were experts in mathematics, so they used a hedge fund that used algorithmic trading to make investment decisions. But, after two years, Bhatt and Tenev decided to start their next business. They launched another business model, Chronos Research. It was a start-up that sold software for Low-latency Trading to other financial companies or institutions like banks and hedge funds. Like its predecessor, Cronos never actually took off.

The idea for Robinhood originated from some of the market developments that the founders saw. At first, people were becoming more and more comfortable using their phones to manage everything from finances to social contacts.

Next, the financial system and confidence in Wall Street were at an all-time low due to the Great Depression. These sentiments were explained by the Occupy Wall Street movement that began to gain traction in late 2011.

The founders also observed that access to stocks and other investment opportunities was reserved for the top 1% of society. Like Charles Schwab and E-Trade, executives were charging clients anywhere between $5 to $10 fees for a trade that made it redundant for the average Joe to invest. The charge was high from a trading perspective. After planning everything, Vlad Tenev and Baiju Bhatt decided to start their new company. But, they needed financial support to start. So, they pitched the idea for the Robinhood company to over seventy-five thousand investors. But unfortunately, the investors didn’t agree to invest in the Robinhood project. So, due to the extensive capital requirement, the founders couldn’t go ahead to start a brokerage company.

Finally, after a lot of hard work, they convinced two famous businessmen, Marc Andreessen and Tim Draper, to invest 3 million dollars into the startup’s seed round. The announcement came in April 2013. Vlad and Baiju started the Robinhood website, and it went live at the start of 2014. In December 2014, they launched Robinhood app for iOS. In August 2015, they released the Android app. By that time, the waiting list for Robinhood had grown to over 800k, making it one of the best launches in the history of entrepreneurship.

Vlad and Baiju raised another 13 million dollars before the debut, allowing to an increase in interest levels. Robinhood was finally opened to the public with a $16 million war chest. The funding allowed Robinhood to pull top programmers or engineers from the biggest brands, such as Facebook and Uber, which the founders considered necessary to maintain their applications safe and secure.

Within a year of debut, Robinhood may attract about a million members, handle over $1 billion in transactions, earn an additional $50 million in financing – and perhaps make Apple the first Fintech business to get the coveted Design Award.

In 2016, Robinhood introduced two important innovations to enhance the company’s growth. At first, Robinhood Instant was created, allowing customers to borrow up to $1,000 for trading purposes and clear their deposits. Furthermore, consumers can quickly turn over any proceeds from the sale of their stock which usually took a few days to transfer.

But there was a slight catch: To gain access to Instant, more users had to join a waiting list. But, of course, the more friends a user invited, the more likely they were to be placed on the waiting list, which accelerated the startup’s growth.

Robinhood Gold, the company’s premium membership service like Netflix, was the second feature of Robinhood. With a minimum balance of $2000, customers could borrow up to two times the amount and trade immediately on $10 per month. The two characteristics drove Robinhood to unprecedented heights. Robinhood became the fastest brokerage ever to reach $2 billion in transactions in 2016. In addition, Robinhood launched a different queue to grow its initial overseas market, Australia. At the time, Australians had to spend more than $50 for a single trade, overshadowing conventional American brokers, which had a substantial amount of $7 to $10 cost.

In January 2018, the next most significant breakthrough came when customers traded cryptocurrencies like Bitcoin and Ethereum on the Robinhood platform. At that time, Coinbase charged consumers 1.5-4% for each cryptocurrency trade. Moreover, more than 100,000 users of the Robinhood app were often searching for crypto news. During a survey of its customers, it is found that the users would invest 95 percent in crypto-currency. Finally, a fantastic illustration of the rapid speed at which the company operates was the rolling out of its crypto-currency product. It was just two months since Robinhood and its engineering team initiated the crypto-currency product for their customer base.

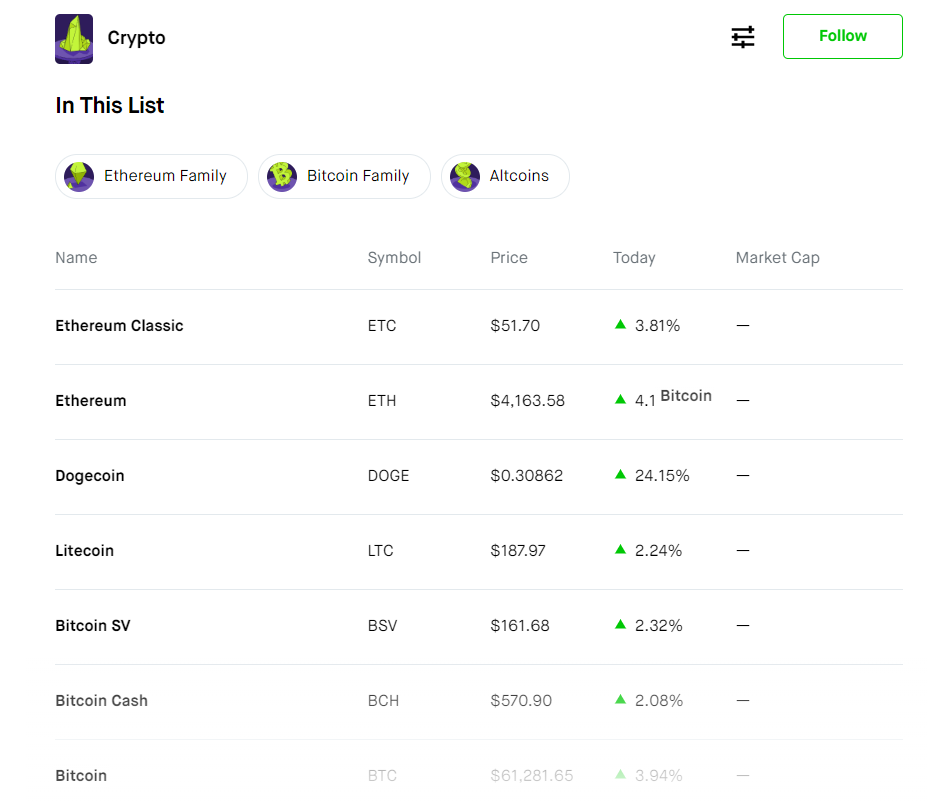

Only seven Cryptocurrencies are available on the Robinhood platform such as Bitcoin, Bitcoin Cash, Bitcoin SV, Ethereum, Ethereum Classic, Light Coin, and DOgecoin. All those crypto currencies are fundamentally strong. Dogecoin was the last coin listed on Robinhood. Till now, it is the only meme coin available on Robinhood. Robinhood began enabling customers in a few states in the United States to trade Bitcoin and Ethereum in January 2018, before introducing other cryptocurrencies like Dogecoin in the month of July and extending to the majority of the United States.

The team used this discipline when it was announced in December 2018 to start a banking product known as Robinhood Checking & Savings. With a 3% interest rate and later SIPC insurance, Robinhood would provide its users with a checking and savings account. At that time, the average rate in the United States was 0.08% and 0.10%, respectively. But the fact is, it was not a banking product, just an extension of Robinhood’s Checking and Savings product’s brokerage account.

In October 2019, the cash management product was released. This time, Robinhood spent the effort to verify that everything was set up correctly by providing FDIC protection through its banking partners, including Citibank, Goldman Sachs, HSBC, Wells Fargo, and more.

By 2019, Robinhood’s fame has eventually struck the internet investment sector. As a result, some of the largest competitors at FinTech have said they will reduce their charges for good, including E-Trade Charles Schwab. A few essential elements underpinned Robinhood’s rise to national popularity. First, when it comes to the free marketing of users, Robinhood was ahead. Second, the simplicity of the application made it very easy and user-friendly for new users also. Robinhood brand struck the coffin.

The company was labeled the trade location for the average joe and associated with a hero who takes money from the affluent and distributes money to the needy, making it accessible to all. The trade data of the Robinhood brand were made publicly available through an API.

The company has even introduced some application features that speed up social sharing. For example, a profile feature has been added that allows and encourages users to share their businesses publicly. Robinhood users became great app advocates and even held forums to boast about their companies. The most significant aspect is the wallstreetbets forum of Reddit, which today has more than 2 million users alone. TikTok videos frequently garner more than 10 million views under #robinhoodstocks.

Robinhood has been grabbing headlines for years now with its promise of commission-free stock trading, which is still going strong. The company announced this year that it is being valued at $7.6 billion. This impressive valuation has placed Robinhood in the top five most valuable US startups for 2019 and 2020. And there didn’t seem to be any slowing down in sight. It is a commonly held belief that free trading platforms do not survive and that they only get to grow in the long run by offering discounted trading services.

As of December 2017, Robinhood is the second largest competitor in a mobile application that allows its users to buy stocks at zero commission. The company enables its users to purchase stocks for free. Robinhood has 2 million users, but it’s expected to grow as much as 200% by 2020. The company is also making efforts to attract more users by offering cryptocurrency trading services.

In 2017, Robinhood earned $363 million in revenue, and the projected revenue for 2018 would be between $500 million and $1 billion. It was also working on margin trading and new features to improve its profit margin.

It can get more capital from the expansion of its business to Korea and Japan. The new company will also contribute to attracting more users within the United States. Robinhood has millions of users in California, Texas, Florida, and New York. By the end of 2018, they are planning to add Massachusetts, Georgia, and Colorado. To succeed in Japan and Korea, Robinhood has hired Jordan Verillo as head of international growth.

As per the previous record, Robinhood had twenty-three thousand and seven hundred employees, and its main competitor, Charles Schwab, had only five hundred and ninety-five customers per employee.

Robinhood assured its users that the company aggressively invest in making its platform user-friendly and safe. In addition, it would help the users to understand the platform very quickly. It involved the release of information on trading options, UX improvements, and a contribution of $250k to the American suicide prevention foundation. The firm also pledged to cooperate closely with the regulators of the United States.

But even the flow of negative headlines (including the retired United Kingdom start-up and a cyberattack on a few thousand Robinhood accounts) could not halt Robinhood in its growing track. For example, Robinhood claimed that in June, average daily trades were 4.3 million – above the combined number of E*Trade and Charles Schwab!

However, the trading app was the focus. Robinhood received many criticisms in January 2021, when it prevented customers from buying AMC, GameStop, and other stocks. Many felt that the hedge funds directed their management staff to establish the trade chain.

CEO Tenev stated that they “with no hedge fund and no market maker,” and said the aim is to “defend the company and safeguard our consumers.” Tenev was even speaking to CNBC. Robinhood has now been obliged to collect $3.4 billion in additional financing to fulfill its collateral obligations and comply with SEC regulations. The harm had been done, though. Users of Robinhood have launched class action proceedings against the company after the trading stop. In addition, the Robinhood app rating on the Google Play Store fell to one, with plenty of people saying that they’d abandon the platform.

So, Robinhood has chosen not to conduct an initial public offering (IPO) soon. Instead, the company intends to strengthen its balance sheet and hire financial specialists to assure regulatory compliance.

Recommended: Moneycontrol App Complete Review with Pros and Cons

How does Robinhood make money?

Robinhood earns money through order flow payments, interest on stock loans, subscriptions, interchange fees, and cash income from uninvested funds. ”How does Robinhood make money?” is one of the most frequently asked questions about Robinhood, which has ranked at least $100 million in just eighteen months. The answer is that they do not use advertisements to sell their services, nor do they pay their workers using shares issued by the company.

They instead use profits from interest earned on cash balances and daily interest payments from loans. What’s more – their platform charges no fees whatsoever- neither for deposits nor withdrawals! Robinhood makes its money this way. They earn interest on all funds that customers loan. The amount of cash and loans is over $1 billion and earns them about $10 million in interest per month.

Robinhood Premium Subscriptions

Robinhood Gold is a premium tier designed to make investing feel accessible and effortless, launched in 2016. With Gold, the users get up to 1 minute of priority access to buy or sell anytime. If the user’s order executes immediately, that’s as least as good as trading hours. The users will also enjoy a gold badge and marketing materials to help them promote their portfolio.

Benefits of Robinhood Gold: – Robinhood Gold Subscription provides the opportunity to invest money in quality stocks, ETFs, and more without paying a commission. The users access exclusive features like instant access to trades, extended trading hours, and no commissions on certain order types. Robinhood Gold is for people who want the chance to get greater returns on their investments without having to pay conventional fees.

The users cash out their money with a debit card for free, with no annual fees, and get a bonus when someone refers a friend to Robinhood.

Robinhood Gold is an upgrade to the primary account that lets the users cash out their money by debit card for free. For the first 30 days, the users can take a free subscription and get all the benefits of Robinhood Gold. After 30 days, the services will be canceled.

After that, the Gold membership costs $5 per month and may go up to $50 per month. The price is based on the amount of money borrowed on margin by traders; if the users use more than $1000 of margin, then $1000.

Now let’s start a discussion about the order flow and payments of the Robinhood platform. Robinhood is the best investing app. It’s easy and fast to use, its prices are already low, and it’s only available on Apple and Android devices. When you place an order on any online trading platform, it sends to the market maker, who pays a modest fee to the forum in exchange for transaction flow.

Market makers frequently propose special offers to compete with stock exchanges such as NYSE or the New York Stock Exchange). Robinhood collaborates with various market makers, including Two Sigma, or Citadel, to provide consumers with the best possible sales price.

The market maker aims to benefit from the bid-ask spread, which is the difference between the reported prices for an instant sale and an immediate buy. As a result, it is essentially an arbitrage company.

How Robinhood generates revenue on cash?

Robinhood makes money from uninvested funds through its Securities segment. The company loans the cash on balance to other banks in exchange for interest payments.

Parts of those earnings are subsequently returned to Robinhood users (after deducting their amount), allowing FinTech to pay its users interest (APY) on balance.

Robinhood Transaction, Withdrawal, and Interchange Fees

The Robinhood app is an investing platform that offers a no-commissions exchange. With the app, users can invest in equities and ETFs, buying stocks or other securities for as little as $1 at a time. Users can also monitor their portfolios and track market data on the go. The company generates revenue by rebating money to investors who use its self-service trading platform Robinhood Gold.

Robinhood offers a seamless withdrawal process. Once the users withdraw their funds, they are transferred into a Meta Trader 4 account and then to your bank account. From there, the transaction can take up to one business day, depending on the customer’s banking hours of operation for deposits and availability of funds.

Robinhood is a no-fee brokerage that has been operating since 2013 and is now worth over $5.6 billion. Robinhood has grown at a rate of 240% in the past year, as more customers opt to trade stocks and other assets through this platform. As anyone in the financial industry will tell you, great power comes with great responsibility, and Robinhood is no exception. Robinhood, in collaboration with Sutton Bank, provides a Mastercard debit card. When a user pays with a debit card, the merchant is paid an interchange fee.

The card’s issuing bank charges it to Robinhood for each transaction. The interchange fee varies from 1.5% and 3%. Some of the cards sets standards charges the merchant must pay their bank to process the transaction. Concerning this fee, one could say that it’s high as about 40 times more expensive than what most debit cards charge their customers while providing comparatively poor benefits. So considering its service level, fees are pretty reasonable in comparison – although still not ideal – with other debit cards.

Investment on Margin

Robinhood Margin Investing is a highly speculative investment strategy in which an investor buys securities using borrowed money. This investment is available through a margin account, which means that the investor borrows money from the broker to purchase stocks and other securities on margin. When the value of those assets decreases, it can be difficult for the investor to pay back their debt with interest.

Investing on margin enables Robinhood users to borrow funds from the company to collect stocks. Robinhood earns money from the interest it charges on these loans. Users pay an annual interest rate of 5% on any margin above $1,000.

Robinhood determines how much a trader may borrow based on his or her account balance. It enables the firm to estimate the risk of payment failure more accurately.

If the trader’s portfolio value falls below a specific level, they will receive a margin call. In that scenario, the trader must either deposit additional funds into the account or sell shares to reach the needed minimum level. Robinhood has been chastised in the past for enabling customers to trade on margin. Its primarily young user, along with historical market volatility, may expose traders to risks that they are unable to bear.

Robinhood Cashback or Reward Program for Users

The promotion incentive deadline was on February 19, 2021. Customers who were qualified for the offer would get an email at that period registered on the Robinhood platform.

If a user’s account was qualified for a deposit match cash incentive, they matched 5% of the user’s next deposit up to $150. Once a customer’s deposit is cleared, the incentive would be instantly credited to their account balance. The top cash prize was $150. A $3,000 deposit, for example, earned $150.

Expected Revenue of Robinhood in 2021

A brief introduction regarding Robinhood’s revenue and expected revenue in 2021: Robinhood is one of the fastest-growing financial services platforms, with a billion dollars in revenue as of October 2018. However, its expected gains will be diminishing from 2020-2021 due to new regulations put into place by the Federal Reserve Board limiting what type of transactions they can support.

Robinhood Financial LLC is an American electronic securities brokerage founded by Baiju Bhatt and Vladimir Tenev.

Recommended: Top 7 Most Surprising Business Models You Never Heard Before You Never Heard Before

What exactly is Robinhood?

In 2013, Robinhood was an online financial investment platform founded by the do-it-yourself trader Vladimir Tenev and Baiju Bhatt. The company currently has a presence in the United States and plans on expanding into the international market. In 2016 Robinhood raised 110 million dollars during its series C funding round. This funding round was led by DST Global’s Yuri Milner, Kleiner Perkins Caufield & Byers, and Index Ventures.

Robinhood Funding is a new funding option from Robinhood, Inc. that allows you to invest in startups on the stock market without paying any fees. The company announced on May 13th, 2016, that it would be introducing this new funding option. It is efficient for small-time investors to purchase stocks for just $0.001 with no fees associated with account purchases or trading or $1 with a traditional brokerage account.

Robinhood has raised over 5 billion dollars in 20 rounds of venture capital funding, according to Crunchbase. Notable company investors include Sequoia Capital, DST Global, Index Ventures, Andreessen Horowitz, Institutional Venture Partners (IVP), and many others. The major investors are Index Ventures, DST Global, IVP, etc. In August 2020, the investors valued 11 billion dollars for Robinhood’s business during the firm’s latest G Round Series. That marks a 36 percent increase in Robinhood’s value, which was 8.6 billion dollars in just two months in July 2020. Like other companies or business models, Robinhood has not revealed its profit publically.

It’s an application that allows users to invest in stocks for free but charges a commission on some options. Robinhood is a mobile app and financial services company that helps people trade stocks and cryptocurrencies for free. Robinhood was founded in 2012 in Mountain View, California, by Vlad Tenev and Baiju Bhatt. In February 2018, Robinhood announced its plans to expand into the UK by launching Robinhood Crypto in March 2018. The company later announced it would launch in Toronto, Canada, and grow to India and Europe by the middle of 2018.

Also, Recommended: How Does DoorDash Make Money?

How to use Robinhood? Tutorial Step By Step

Are you a stock market novice considering joining the Robinhood trading app? And maybe you don’t know how to use and navigate this kind of program? If not, then you don’t have to worry about it, because we have covered everything.

We will show you step-by-step how to use the Robinhood mobile application and which currencies it trades. We will also discuss some significant benefits of joining up with them and how their customer service compares to other well-known trading platforms out there. Below, you will find everything you need to know about Robinhood’s trading app, from signing up to depositing money and investing in stocks. Check the content below to get detailed guidance on how to use Robinhood.

- Robinhood App works on Android and iOS. So, first of all, open up your phone and go to the play store (If you are an Android user) or App Store (If you are using iPhone or Apple phone), and search Robinhood. You will see the app with a white feather and a green icon.

- Go ahead and get the app from there. Then open the app, then you have to complete the sign-up process. Then you have to fill up few personal details.

- To complete the sign-up process you may prefer either the Robinhood app or Robinhood Website.

- After finishing the sign-up process, you will check the dashboard by using your login credentials.

- Registering with Robinhood is very straightforward. All you have to do is fill out the registration form and verify your identity.

- Before starting trading on Robinhood, you have to fill up the bank details. After connecting your bank account, the transaction will be effortless.

- On Robinhood, you may invest in financial assets like exchange-traded funds, gold, stocks, options, and cryptocurrencies.

Recommended: How Does Zoom make money?

Quick Facts about Robinhood

- Robinhood is an investment app that makes it easy to buy and sell stocks, ETFs, options, and cryptos.

- Robinhood is a commission-free trading app that lets you buy or sell stocks, funds, ETFs, and options with no commission charges.

- It’s an awesome platform to start stocks or crypto trading.

- Dogecoin is the only meme coin, which is available on the Robinhood exchange.

- Robinhood provides the proper guidelines to the customers for trade.

- They also provided a tutorial section on their platform, which helps new customers to know invest.

- After the huge popularity of the Shiba Inu token, some YouTubers and social media influencers were predicting that the Robinhood exchange can list Shiba Inu till December 2021. But it’s listed on April 12, 2022.

Also recommended for you: How does Venmo make money?